ASX snaps three-day winning streak over US uncertainty, Myer profit tumbles by 40pc — as it happened

The Australian share market closed lower on Wednesday, ending a three-day winning streak after gloomy investor sentiment returned in the US.

Meanwhile, Myer's profit dropped nearly 40 per cent in the first half of the financial year, as it was hit by stock distribution issues and booked costs associated with its takeover of Premier's Apparel Brands.

Look back on the day's financial news and insights as it happened in our blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: -0.4% at 7,828 points (final values below)

- Australian dollar: -0.1% at 63.58 US cents

- S&P 500: -1.1% to 5,614 points

- Nasdaq: -1.7% to 17,504 points

- FTSE: +0.3% to 8,705 points

- EuroStoxx: +0.6% to 554 points

- Spot gold: +0.1% at $US3,038/ounce

- Brent crude: -0.4% to $US70.32/barrel

- Iron ore: -0.2% to $US101.80 a tonne

- Bitcoin: +1.2% to $US83,016

Prices current around 4:20pm AEDT.

Updates on the major ASX indices:

That's all for today's blog

Thanks for your company throughout the day.

We'll be back to do it all again tomorrow, including the reaction to the latest interest rate decision from the US Federal Reserve overnight.

And if that wasn't enough, the latest unemployment statistics for February will be released by the ABS at 11:30am AEDT.

See you then!

LoadingComing up tonight on The Business

If you're after more business and finance news, here's a sneak peek of what's coming up on The Business:

- Rhiana Whitson looks at whether the federal government should be rolling out subsidies for home battery storage systems;

- Kirsten Aiken speaks to Marcus Hellyer from Strategic Analysis Australia about Canada's $6.5 billion high-tech Australian military purchase; and

- Governance expert Helen Bird dissects the findings from WiseTech's board review into its co-founder and executive chair, Richard White.

Catch The Business on ABC News at 8:45pm, after the late news on ABC TV, and anytime on ABC iview.

Gas is the elephant in the room

Why are renewable energy costing so much power prices are going up we send so much o/s that we don't have enough reserves for us in Australia can't the Government see that?

- chrisso

Believe it or not Chrisso, three prime ministers have previously called that exact thing out when it comes to gas — Anthony Albanese, Scott Morrison and Malcolm Turnbull.

Here's how our chief business correspondent Ian Verrender summarised it yesterday:

"For a nation that is one of the world's biggest energy exporters, it is a situation that defies logic and reeks of an epic policy failure."

I've linked his full analysis below in case you missed it and are in search of something to read on your afternoon commute:

Australian shares snap three-day winning streak

After a brief rebound, the slide has returned to the local share market, with the ASX 200 shedding 0.4% to close at 7,828 points on Wednesday afternoon.

The broader All Ordinaries also closed lower, down 0.4% to 8,054 points.

The return of gloomy investor sentiment in the US meant the three-day winning streak for the local share market had run its course, with healthcare the only sector finishing in positive territory.

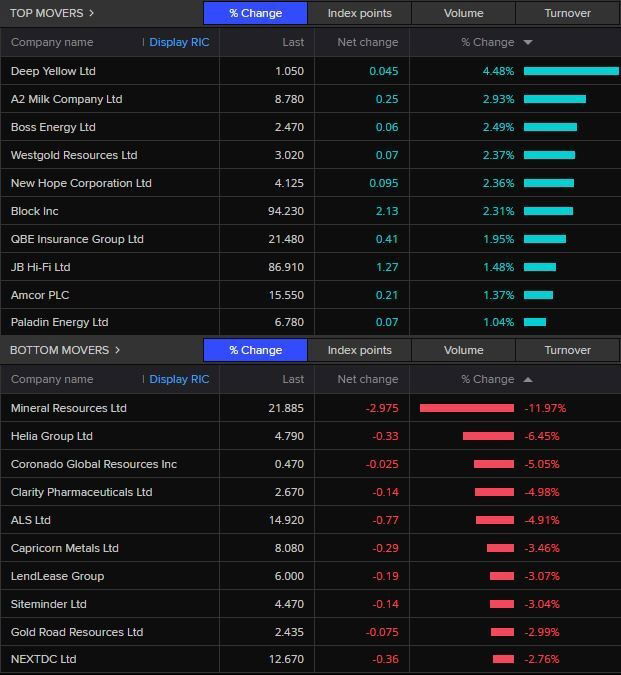

As for the best-performing stocks:

- Codan +6.6%

- Deep Yellow +4.5%

- QBE Insurance +4.3%

- New Hope +4.2%

- Boss Energy +4.1%

While the stocks with the largest declines:

- Helia Group -16.3%

- Clarity Pharmaceuticals -6.4%

- Coronado Global -6.1%

- Pinnacle Investment Management -5.7%

- Lifestyle Communities -4.6%

Light-sensitive eyeballs are welcome here

Cannot believe you made a comment about the lights in Myers! I worked in Myers for almost 2 years and the reason I left was because of the fluorescent lights. Had to walk out at every break to get away from them. Eventually one day I walked outside, then I walked back in and resigned. When the boss tried to convince me to stay, I said, “ I can’t, it’s the lights”! My Eyes, my eyes!

- Peter

Impressive that you were able to stick it out for nearly two years, Peter! Hopefully you've managed to find a job with more eye-friendly lighting since.

I'd never given retail lighting much thought at all until it kept coming up in conversations with very smart people I get to talk to in this line of work, and it's become one of those things I can't unsee (pardon the pun). Retail psychology is a real thing!

Should we have a national subsidy scheme for household batter installations?

Rising power bills and cuts to solar feed-in tariffs are seeing a rise in household battery sales — but getting them installed is an expensive exercise.

That's prompted calls for a national subsidy scheme, as business reporter Rhiana Whitson explained to ABC News Channel earlier today:

Loading...If you haven't already, you can read Rhiana's story below (or watch it tonight on The Business at 8:45pm AEDT on ABC News.)

Surfing, you say?

Hey Kate 🫤👋 I was in the office this morning, then site surfing. My new boss is Brisbane based and was in Sydney...

- Natty

Hello Natty! And here I was thinking we might have to send out a search party for you if we didn't hear from you before the close of trade.

Speaking of surfing, this may be of interest ... or at the very least, be a little mid-afternoon pick-me-up.

Hospitality business closures hit record high in February

The latest report from CreditorWatch shows that hospitality businesses closed in record numbers last month, as the sector struggles with low customer numbers and rising business costs.

In the 12 months to February, hospitality closures hit a record high of 9.3% — equivalent to one in 11 businesses — up from 7.1% a year earlier.

Specifically, the CreditorWatch report noted that the food and beverage services sector was struggling the most, with rising food costs, energy bills, insurance premium hikes, wage increases and higher rents all putting pressure on businesses to keep their doors open.

But business owners say the answer is more complicated than raising their prices to make up the shortfall.

"You can only pass it on so much before people won't buy any more," Geraldton cafe owner Pia Richardson said.

For more, you'll find the full story from ABC Geraldton's Brianna Melville below:

The federal government is sending billions offshore, but why?

The federal government has sent tens of billions of dollars offshore in payments since mid-2023 — in fact, it's sent over $3 billion since late last year.

We know this because the Reserve Bank (the banker to the federal government) dutifully records the running down of its foreign exchange reserves — foreign exchange reserves that are being transferred to government coffers.

The numbers are so large it's caught the interest of independent economist Saul Eslake.

"The RBA can supply the [foreign exchange] the government needs by running down its own reserves, or (if for whatever reason it doesn't want to do that) it can buy the FX in the market — which it looks as though it's been doing in most instances," he said.

"[It] looks like the government has been spending a lot of money overseas recently.

"Some of that could have been the $800 million Richard Marles took with him to give to the US as part of the AUKUS Treaty."

The ABC has asked Treasury why the government's been sending so much money overseas — we'll update the blog when the number crunchers reply!

Bank of Japan leaves interest rates on hold

The Bank of Japan has left interest rates on hold at 0.5% as it waits to see how higher US tariffs will affect the domestic and global economy.

Economists had widely expected that the BOJ would keep rates on hold, as it navigates a potential slowdown caused by US President Donald Trump's tariffs, while trying to achieve its 2% inflation target.

"Concerning risks to the outlook, there remain high uncertainties surrounding Japan's economy and prices including the evolving situation regarding trade and other policies in each jurisdiction," the BOJ said in a statement.

The BOJ last raised interest rates in January, but voted unanimously to keep them on hold at 0.5% today.

(There's also another big central bank meeting happening overnight … but more on that later!)

Why gold is going up and up (and up)

Wherever there's uncertainty in markets, you can almost guarantee gold will be in hot demand — and that's certainly the case right now, with the gold price hitting an all-time high.

But how much of it is to do with mounting fears of a global trade war? Here's friend of the blog David Taylor with a short and sweet explainer:

Retail therapy is complex

Myer needs to decide who its customer is. The Ballarat store is so shabby, I feel dirty walking into it. it disincentives me to spend because of the way it looks. For my budget Myer is a 'treat' but shopping there is anything but. Even the local Kmart's look more upmarket.

- Ballarat resident

Ah, the good ol' Ballarat Myer! I'm a long, long way from Sturt Street these days, but I'm very familiar with it as a former resident. (Shoutout Ballarat blog readers!)

Is there anything about the store in particular that makes you feel that way? I ask because one theory that various people have suggested to me about Myer's perception is the lighting in its stores.

Their explanation for that is, generally speaking, the lights in Myer stores are overly fluorescent and cool, giving it that "bright white" look to shoppers that feels more "doctor's office" than "department store".

Of course, that's just one theory and there's more that goes into how a brand is perceived and how a retail business performs, but it's food for thought!

WiseTech shares steady after review into Richard White's conduct

WiseTech shares remain fairly muted after the company released some of the findings of a review into co-founder and executive chairman Richard White's conduct.

Two law firms reviewed Mr White's conduct after allegations about his personal life made headlines and employee complaints surfaced, with the review finding that he had misled WiseTech's board about the nature of several relationships.

In a statement, Mr White said he accepted the findings and understood the "seriousness of his actions", and he had committed to supporting a new code of conduct at the company.

But the release of some of the review's findings has done little for WiseTech's share price — it's up 0.3% to $85.01 as of 1:15pm AEDT.

You can read more about the review and its findings below:

ASX flat after recovering from earlier dip

As we head into the afternoon, the ASX 200 is flat, hovering at 7,862 points as of 12:50pm AEDT.

It's a slight recovery for local shares after they saw an early dip, following heavy selling on Wall Street overnight.

Across the sectors, it's a bit of a mixed bag — five out of 11 are in the green, with industrials and financials both up 0.3%.

As for the top-performing individual stocks:

- Codan +6.1%

- QBE Insurance +4.2%

- Liontown Resources +4.2%

- Deep Yellow +3.7%

- JB Hifi +3.3%

While the stocks with the biggest losses so far today:

- Mineral Resources -6.8%

- Helia Group -6.1%

- Lifestyle Communities -5.5%

- Clarity Pharmaceuticals -4.8%

- Capricorn Metals -4.4%

MinRes pauses haulage on Onslow Iron road after truck rollover

Mineral Resources has temporarily paused haulage (or commercial transport) on its Onslow Iron haul road in WA's Pilbara after a truck rollover earlier in the week.

On Monday, the rear two trailers of a road train tipped onto their side on the Onslow haul road — which is a crucial network for the miner to transport iron ore shipments.

The road train driver wasn't injured, and the incident has been reported to WorkSafe WA. MinRes is also internally investigating the cause of the rollover.

It's the sixth accident involving the miner's new Onslow road since August last year.

MinRes has told the ASX that haulage will continue with contractor vehicles using alternative routes, and it doesn't expect the pause will impact its full-year guidance of iron ore shipments.

Shares in MinRes are trading lower, down 6.6% to $23.23 as of 12:05pm AEDT.

Energy Australia and Vic government refute News Corp report on Yallourn coal station extension talks

Energy Australia has confirmed that the closure of the Yallourn power station will happen by 2028 and will not be extended.

It followed an article in The Australian newspaper on Wednesday saying the major coal power station in Victoria's Latrobe Valley was "set to stay open for four more years amid fears of devastating electricity shortages" and "a series of rolling talks had been held between AEMO and Victoria's Department of Energy, Environment and Climate Action over the mooted extension".

Energy Australia told the ABC that the claims in the newspaper were wrong.

"We have committed to Net Zero by 2050 and closing Yallourn by 2028 is part of that commitment," the company said in a statement.

"We have not met with the Victorian Government, or AEMO, to discuss extending the Yallourn power station."

The Victorian government also refuted the claims.

"The three agencies also confirm that no such discussions have occurred and nor have there been 'rolling talks'," a joint statement from the Victorian premier and minister for energy and resources said.

"AEMO has not advised the Victorian Government that Yallourn would need to be extended beyond 2028, as claimed in The Australian."

Treasury Wine could benefit from potential Trump tariffs on wine: Morgan Stanley

Morgan Stanley says the Australian wine producer Treasury Wine could stand as a beneficiary of potential tariffs on US wine disrupting the market.

The investment bank estimates imported wines constitute about 30% of total US consumption by value.

US President Donald Trump last Thursday threatened to slap a 200% tariff on wine, cognac and other alcohol imports from Europe.

The bank says the wine producer's Treasury Americas unit, which contributes about 38% to group revenue, may benefit from lower supply and increased pricing power as most of the unit's net sales revenue is domestically produced.

Brokerage maintains an "overweight" rating and price target of $12.90. It's currently down 0.9% to $9.98.

Thirteen of 15 analysts rate the stock "buy" or higher, and two as "hold", according to LSEG data.

Stock is down 11% so far this year, including current session's moves.

Star directors case continues in Federal Court

Regulator ASIC dragged practically the entire former board of Star Entertainment to court for not doing their jobs.

There's a more legalistic definition, but it's essentially about "directors' duties", and not doing enough to ensure that Star Entertainment complied with Australian law.

It's a big case with potentially far reaching consequences for boards across Australia about how curious and independent directors need to be.

Some of the 11 former directors and executives have already ended their cases by accepting penalties including fines and "banning" — being unable to run companies for a period of time.

The rest are defending the allegations in the Federal Court, in a case that is ongoing.

Currently in the witness box is Star's former company secretary and group general counsel Paula Martin.

You can tune in on this live-stream.

ASX falls

The Australian share market has fallen at the open.

The ASX 200 was down 44 point or 0.6% to 7,817, by 10:15am AEDT.

Nine out of the 11 sectors were trading in the red, with tech, utilities and real estate leading the losses.

Here were the top and bottom movers in the first 15 minutes of trade.